Brent Crude Oil

Advanced Real-Time Chart <spot price per barrel in USD>

Brent crude oil is a globally recognized benchmark for pricing oil, representing a blend of crude from several North Sea fields. The major producers include the United Kingdom and Norway, with contributions from Denmark and the Netherlands. Key fields include Brent, Forties, Oseberg, Ekofisk, and Troll. Brent crude is a light, sweet oil with low sulfur content, making it ideal for refining into gasoline and diesel. It influences about 70 – 75% of the world’s traded oil and is widely used in Europe, Africa, and Asia. Despite declining production, Brent remains a crucial reference for global oil pricing and trade.

WTI Crude Oil

Advanced Real-Time Chart <spot price per barrel in USD>

West Texas Intermediate (WTI) crude oil is a key benchmark for U.S. oil prices, known for its light, sweet quality and low sulfur content. It is primarily produced in the United States, with major oil fields in Texas, North Dakota, Oklahoma, and New Mexico. WTI is sourced from inland oil fields and stored at Cushing, Oklahoma, a major distribution hub. It is widely used for refining into gasoline and diesel, making it crucial for the North American market. Compared to Brent crude, WTI is usually cheaper due to higher U.S. production and transportation limitations. It accounts for approximately 20 –25% of global crude oil trade.

Market Data on Energy Futures Contract

Exchange: ICE (London – Intercontinental Exchange) and NYMEX (New York – CME Group)

A futures contract is a standardized legal agreement to buy or sell an asset (such as crude oil) at a predetermined price on a specified future date, commonly used for hedging and speculation in financial markets. The price of a futures contract is closely linked to the spot price, with the difference influenced by factors such as storage costs, interest rates, and market expectations of future supply and demand. 🛢️⛽🔥

Trading Allocation and Primary Influence

The way crude oil is traded is split between the spot market, where buyers purchase physical oil for immediate delivery, and the futures market, where traders buy and sell financial contracts to lock in prices for future delivery.

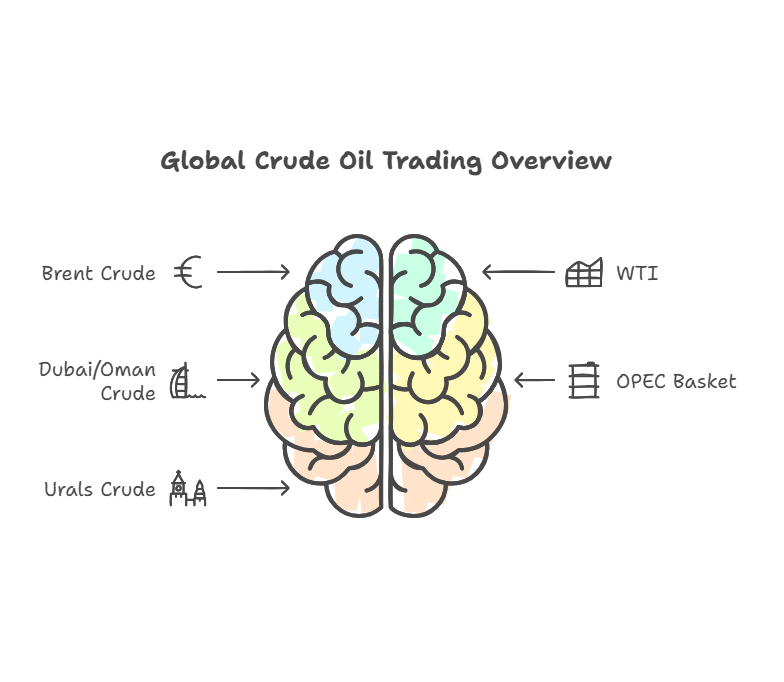

| Crude Oil Benchmark | Market Share in Spot Trading | Market Share in Futures Trading | Main Trading Hub | Primary Influence |

| Brent Crude | 70–75% | 50% | ICE (London) | Global benchmark (Europe, Africa, Asia) |

| WTI (West Texas Intermediate) | 20–25% | 45% | NYMEX (CME, New York) | U.S. market, some global influence |

| Dubai/Oman Crude | 5–10% | 5% | DME (Dubai) | Middle East & Asia pricing |

| OPEC Basket | Not directly traded (reference price) | Not actively traded | OPEC member nations | Used as a reference price for crude oil from OPEC producers |

| Urals Crude (Russia) | 5% | Limited (most transactions occur through spot trading and long-term contracts) | SPIMEX (Russia), Rotterdam (Netherlands), Asian ports (China, India) | Mainly exported to Europe and Asia, increasing trade with China and India |

🌍 Story on OPEC 🌍

Organization of the Petroleum Exporting Countries

The Organization of the Petroleum Exporting Countries (OPEC) is an intergovernmental organization founded in 1960 to coordinate oil production policies among member nations and stabilize global oil markets. OPEC’s primary goal is to regulate oil production and pricing to ensure a balance between supply and demand, preventing extreme price fluctuations.

As of 2024, OPEC’s member nations include Saudi Arabia, the United Arab Emirates (UAE), Iraq, Iran, and Kuwait in the Middle East; Algeria, Angola, Congo, Equatorial Guinea, Gabon, Libya, and Nigeria in Africa; and Venezuela in South America.

OPEC also works with non-member countries, known as OPEC+, including Russia, Kazakhstan, and Mexico, to strengthen global oil market stability.

OPEC plays a crucial role in global energy markets, influencing oil prices through production quotas. By adjusting supply, OPEC can impact inflation, fuel costs, and economic growth worldwide. Despite facing challenges from renewable energy growth and U.S. shale production, OPEC remains a dominant force in the oil industry, shaping policies that affect economies, geopolitics, and global trade.

Video courtesy of CNBC. All rights belong to the original creator.

Video courtesy of CNBC. All rights belong to the original creator.

2020 Oil Price War: A Supply Shock or A Conflict

March 2020 – A breakdown in negotiations between Saudi Arabia and Russia over production cuts led to increased output, causing a price collapse.

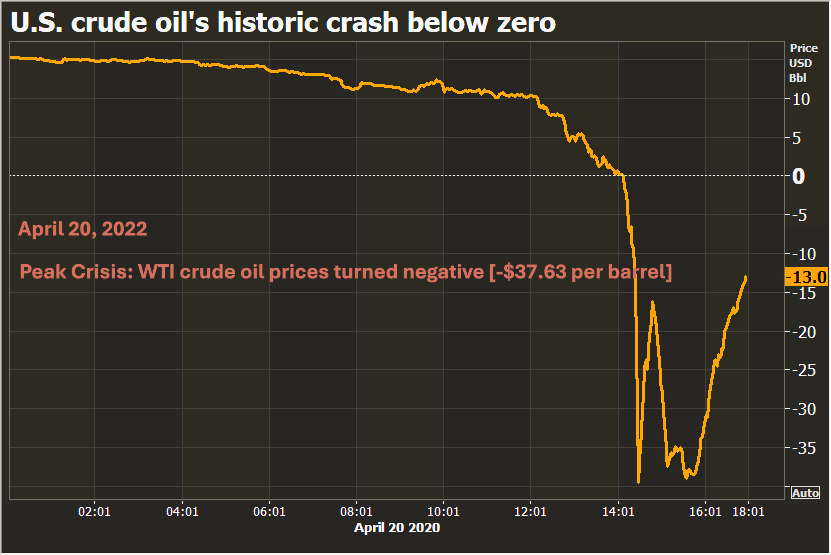

April 2020 – Oil demand collapsed due to COVID-19 lockdowns. On April 20, 2020, WTI crude oil prices turned negative [-$37.63 per barrel] due to storage shortages. 📉

June 2020 – OPEC+ agreed on production cuts, leading to gradual price recovery.